Canada's Critical Minerals: 101

The term “critical minerals” has become ubiquitous in Canadian and global news, but for those outside the mineral industry, it may not be clear what that means.

Even for those engaged in the mineral exploration and development sector, it can be challenging to explain how critical minerals affect Canadians. To help, we've answered seven of the most common questions about critical minerals – including what they are, where they can be found, how they can be used, and why they are so important for Canada.

Frequently Asked Questions

Critical minerals are minerals essential to the development and production of modern technology. Critical minerals facilitate:

- The continued use of widely-adopted technologies, such as cell phones and laptop computers powered by lithium-ion batteries;

- The evolution of low-carbon fuel sources, like solar panels and wind turbines containing cobalt and nickel;

- The development of new technologies that will contribute to the global transition to net-zero.

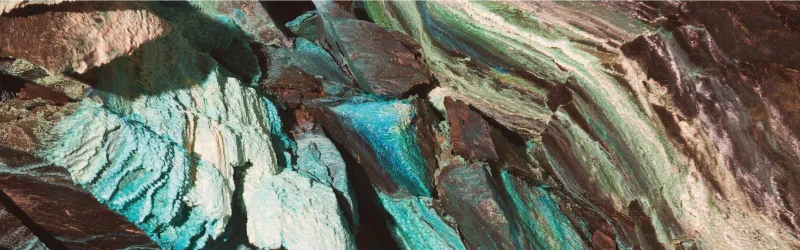

Critical minerals have historically been mined and processed as byproducts of precious or ferrous metals, like gold and iron. The growth in demand for critical mineral deposits is relatively new and closely linked to increasing demand for green technologies to decrease emissions in all aspects of modern life, from consumer goods to manufacturing itself. This presents an important opportunity for Canada, as a country settled on geologically diverse and mineral-rich land, to build a robust critical mineral supply chain and become a global leader in the just transition.

What makes a mineral critical?

The criticality of a mineral is largely dependent on its availability. High-purity iron, for example, is used alongside or alloyed with critical minerals in many essential sectors, including aerospace applications, and battery manufacturing; however, due to the abundance of iron ore, it is not generally considered a critical mineral. Conversely, minerals with fewer applications but smaller supply may be assigned the label of critical mineral—this is the case for niobium, a mineral that strengthens iron alloys for use in high-temperature applications, like airplane engines and wind turbine blades.

In Canada, the government has identified 34 critical minerals, based on three criteria:

- A critical mineral is one essential to Canada’s economy, but whose supply is threatened; or

- Is required for the transition to a low-carbon economy; or

- Is a sustainable source of highly strategic critical minerals for Canada’s partners and allies.

It is clear that the definition of a critical mineral is dependent on variable market factors, particularly supply and demand, and as such the federal government has committed to reviewing and updating the critical minerals list every few years.

Why are there many different lists of critical minerals?

Many countries across the world have published their own critical mineral lists or strategies, which vary based on their national interests. Canada’s lists 34 minerals, with a focus on six: lithium, graphite, nickel, copper, cobalt, and rare earth elements (REEs).

Some minerals are included or excluded based on their availability in a region: for example, potash, a fertilizer component abundant in the Canadian prairies, is included in Canada’s critical minerals strategy as its exports produce significant benefit for the country’s economy. Its criticality in Canada is predicated on our ability to mine it; our trading partners in the U.S. and E.U., on the other hand, do not consider it to be critical, as they do not produce it in significant quantities and have a reliable source in Canadian exports. Another example is coking or metallurgical coal, which is deemed critical by the E.U. in order to advance their green steel production initiatives and avoid destabilizing coal-dependent economic sectors. In Canada, there is no such economic pressure linked to coal, and as such the critical minerals strategy focuses on other minerals

Critical minerals are found in primary deposits across the world, and as byproducts of other mining activities.

How are critical mineral deposits found?

Generally, critical mineral deposits are found by geologists working from survey data, which is the geological mapping of a region. In Canada, the Geological Survey of Canada is responsible for surveying the land to determine the type and formation of deposits in various regions; this information is then made public for geologists and other professionals to use in their work to confirm the presence and viability of mineral deposits. Having complete surveys of many regions is important to minimize the impacts of exploration activities on land and communities.

When data indicates the presence of a deposit, its viability can be confirmed in a number of ways, including geochemical sampling and drilling. At this stage, exploration geologists visit deposit sites and are generally working form basic, temporary camps, with minimal disruption to the local environment. This fieldwork is the first step to building a mine, but it does not guarantee that development.

Where are the critical minerals in Canada?

Critical minerals are all over Canada—in fact, it’s likely many deposits have yet to be discovered! To date, Natural Resources Canada (NRCan) has developed a map of critical minerals projects in Canada, including advanced projects, mines, and processing facilities, with an option to simultaneously show the geology of the region. The Geological Survey of Canada, the United States Geological Survey, and Geoscience Australia have also developed a collaborative map of critical minerals across the world, with an accompanying legend.

How are mineral byproducts recovered?

After minerals are extracted from the earth, they are processed to recover the mineral of interest. This portion is called the concentrate, which is further refined to generate a saleable product, while the remaining material becomes waste, called tailings. Some processing plants are built with the intention of recovering minerals beyond the primary mineral in the deposit: this is common for cobalt, for example, a critical mineral often produced as a byproduct of nickel or copper. In fact, up to 90% of the cobalt produced in 2021 was as a byproduct.

In such cases, the tailings from the primary concentrate are worked through a secondary processing circuit, which generates a second concentrate stream and a final tailings stream. While this stream may be processed again for other trace minerals, it is generally discarded in tailings ponds outside the plant. Meanwhile, the concentrate stream can be sold to manufacturers for use in consumer goods.

Several critical minerals are commonly found as byproducts of other valuable minerals, but in many cases, the mining and processing facilities for these deposits were developed before the criticality of these minerals was identified. This means that rather than being processed to generate value and increase supply of critical minerals, these key materials are sent to the mining equivalent of a landfill—however, as awareness of and demand for critical minerals increases, new ways of recovering these streams are being developed.

One way to recover critical mineral byproducts is to retrofit a plant to incorporate a secondary processing stream. This method has multiple advantages: not only does it increase the value of saleable product being generated by a mine, but the Canadian government also supports such expansions as critical mineral development projects.

The disadvantage of retrofitting a plant to process secondary minerals is that this method cannot account for the value discarded in tailings prior to the retrofit. Many researchers are currently developing the possibility of “re-mining” tailings, where waste deposits would be characterized by geologists to identify potential value streams, then re-processed to recover those minerals. While there are limits to this approach, largely due to the safety risks associated with working with tailings—which often have the consistency of quicksand, unlike the hard rocks found in most primary deposits—it is a highly promising field of research. Re-mining tailings would mitigate the risk of critical mineral shortages while providing significant environmental benefits, like the rehabilitation of orphaned or historical mines.

Are there other sources of critical minerals?

Many critical minerals deposits have yet to be found, and as geologists begin focusing on this sector, it is likely that new discoveries are imminent. Public geoscience, like the surveying of land by associations like the Geological Survey of Canada, is essential to facilitate these future discoveries. With more data like this at their disposal, geologists and explorers will be able to identify deposits while minimizing disturbance to communities and ecosystems.

In addition to mining, recycling will be an essential source of critical minerals in the future, as their deposits are finite. Many of the minerals currently in our phones, cars and laptops could be re-used for other applications if they could be efficiently and effectively separated from other components. While recycling technology requires further research and development to reach this point, many researchers believe that developing the “urban mine” of consumer goods is essential to maintain the supply of critical minerals for future generations.

There are nearly countless applications of critical minerals, from consumer goods to clean technologies and security applications. Some examples may be familiar, like the use of lithium, graphite and nickel in rechargeable batteries for phones, laptops and electric vehicles, as well as larger-scale batteries for energy storage, or the use of nearly any critical mineral to strengthen alloys. Other, perhaps lesser known examples include (but are not limited to):

- Lithium in air conditioning systems;

- Lithium in shatter-proof glass and ceramics, used for consumer applications and in healthcare;

- Graphite in vehicle brake linings and other lubricating applications;

- Nickel in a number of industrial applications, like power plant components;

- Nickel in medical implants;

- Cobalt in paints and inks;

- Copper in nearly all applications involving wiring—like phone lines and internet cables;

- Rare earth elements in permanent magnets;

- Rare earth elements in thin, durable lenses for glasses;

- Gallium in LEDs;

- Titanium and zinc in sunscreen;

- Titanium in metal alloys essential to the flight of airplanes and spacecraft;

- Scandium in high-tech hockey sticks and skis;

- Magnesium in cameras;

- Magnesium in supplements and pharmaceuticals;

- Niobium in MRI scanners;

- Germanium in infrared night vision systems.

What is the critical minerals value chain?

Much of Canada’s Critical Minerals Strategy focuses on building the critical minerals value chain, which the series of development activities that enable minerals to provide economic and societal value to consumers.

The first step in the value chain is discovery: through geoscience and exploration, critical mineral deposits can be identified. Without the discovery of deposits, there can be no mining or developments on critical minerals, which is why geoscience is so important to the development of this industry.

The next step in the value chain is mineral extraction, or mining, wherein the valuable portions of the deposit are extracted from the earth using a variety of tools and technologies. Between discovery and extraction, however, there are many steps that must be responsibly undertaken, like community consultations, environmental assessments, and permitting processes. The permitting process in Canada is lengthy compared to other significant mining jurisdictions, like Australia, averaging 10-15 years. There are ways to shorten this process without compromising good planning, which includes collaboration with Indigenous and local communities. Public geoscience can contribute to this: understanding which areas are geologically conducive to critical mineral deposits is essential to staking claims in areas that can both maximize the value and minimize the disruption associated to a project.

Following mining, minerals are processed into a saleable product, which is then used in manufacturing for a variety of applications for each mineral. A manufactured product is sold to a consumer, and at end of life, eventually makes its way to a disposal or recycling process.

The sectors in the value chain are interdependent, which is why the federal government’s critical minerals strategy emphasizes the importance of strengthening the full chain in Canada. Increasing our capacity to process and manufacture mined products increases our economic capacity, and protects Canada and its allies against the day-to-day effects of geopolitical instability. For example, many European nations are currently facing a heating crisis due to lack of availability of natural gas. In much of Canada, our geography allows us to rely on hydroelectricity, natural gas, and other sources closer to home— but for that power to reach our communities, all steps of the critical mineral value chain are needed. Being able to discover, mine and process minerals to manufacture components like electric cables in Canada helps protect us from a similar shortage.

Critical minerals are important in the global transition to a lower-carbon future, but they are particularly important in Canada for a number of reasons. Canada occupies one of the most geologically rich and diverse land masses in the world; consequently, there is significant mineral potential in Canada compared to most other countries. This is particularly important as other large, geologically diverse countries like China and Russia have not proven the reliability of their critical minerals supply to Canada and its partners or allies.

Another important aspect of the critical minerals opportunity in Canada is the expertise available locally: up to 75% of the world’s mining companies are headquartered or listed in Canada. This country’s history of cutting-edge mining provides developing critical mineral projects with geological and engineering knowledge that other nations may need to import.

Developing these projects also presents a significant employment and training opportunity for young Canadians, who may not have considered a career in mining outside of critical minerals. Throughout the value chain, developing critical minerals projects across the country will generate billions in stable employment opportunities for Canadians, as well as incentivize the development of infrastructure like roads and broadband access in remote areas.

A final key consideration is that of climate change. Canada remains committed to achieve net-zero emissions by 2050, and recently announced a renewed commitment to protecting biodiversity along this path. While the connection between mining and reduced emissions may not be apparent, critical minerals are needed to continue driving the development and implementation of clean technologies. Indeed, many of the initiatives needed to lower emissions are dependent on critical minerals, whose properties are rarely replicable through other means. Seizing the critical minerals opportunity now will allow Canada to responsibly develop this sector, including by employing public geoscience to identify viable deposits that minimize environmental and community disruption. Ensuring critical development at home continues to grow ahead of the global curve will also ensure continued employment opportunities for many Canadians, along with necessary infrastructure development as we transition toward a carbon-neutral future.

Canada’s Critical Minerals Strategy is a document published by the federal government in December 2021, which was developed with the objective to “increase the supply of responsibly sourced critical minerals and support the development of domestic and global value chains for the green and digital economy.” The Critical Minerals Strategy can be accessed here.

The Critical Minerals Strategy outlines strategic priorities in the development of critical minerals, and represents an important first step in this direction. Its implementation will continue to be followed by PDAC, particularly as it relates to exploration and the development of junior miners.

Several Canadian provinces have also released their own critical mineral strategies, including:

With over 8,200 members across the world, PDAC represents a broad spectrum of the mining industry. While many of our members are primarily engaged in precious metal development, critical minerals are an increasingly important area of focus for us.

Some of the critical minerals initiatives we have helped to develop are linked below, with more to come!

Critical Minerals Exploration Tax Credit (CMETC)

Written Submission for the Pre-Budget Consultations in Advance of the 2023 Federal Budget

Canadian Mineral Exploration Tax Credit (CMETC)

The CMETC is a federal incentive that provides investors in companies exploring for certain critical minerals a 30% tax credit based the amount invested. More information is available on our CMETC page.

Budget 2023

As part of Canada’s 2023 Federal Budget, several initiatives relating to critical minerals were announced or confirmed, including:

- The Critical Minerals Infrastructure Fund, announced in Budget 2022 and now confirmed, that will allocate $1.5 B to transportation and energy products needed to unlock priority mineral deposits;

- The Investment Tax Credit for Technology Manufacturing, which proposes a refundable tax credit equivalent to 30% of the cost of investments in machinery and equipment for processing or manufacturing clean technologies and critical minerals, which will strengthen the downstream portions of the value chain, and may include extraction activities relating to lithium, cobalt, nickel, graphite, copper, and rare earth elements;

- The provision of $500 million over ten years to the Strategic Innovation Fund to support the development and application of clean technologies in Canada;

- The inclusion of lithium from brines in the CMETC and flow-through share regimes.

International collaboration

In December 2022, the Canadian government formed the Sustainable Critical Minerals Alliance with Australia, France, Germany, Japan, the United Kingdom and the United States. The group announced their commitment to sustainable critical minerals sourcing practices, with focus on developing a nature-forward approach, building a circular mineral economy, and supporting local and Indigenous communities. This collaboration comes after a number of other multilateral engagements with these partner countries, including the Canada-EU Strategic Partnership on Raw Materials and the Canada-Japan Sectoral Working Group on Critical Minerals.

Canada has also engaged with the United States on critical minerals, starting in 2020 with the Canada-U.S. Joint Action Plan on Critical Minerals. More recently, carve-outs for Canadian mineral producers in the U.S. Defense Production Act and Inflation Reduction Act have presented an opportunity to access over $300 million in grants from across the border. PDAC is working to understand the availability of these opportunities for its members, and will share details as they are released.