Flow-through Shares

Made in Canada

Investment Tools

Flow-through Shares & the mineral exploration tax credit explained

- A flow-through share is a type of common share that permits the initial purchaser to claim a tax deduction equal to the amount invested.

- The flow-through share regime allows public companies to transfer to investors certain exploration expenditures conducted on Canadian soil.

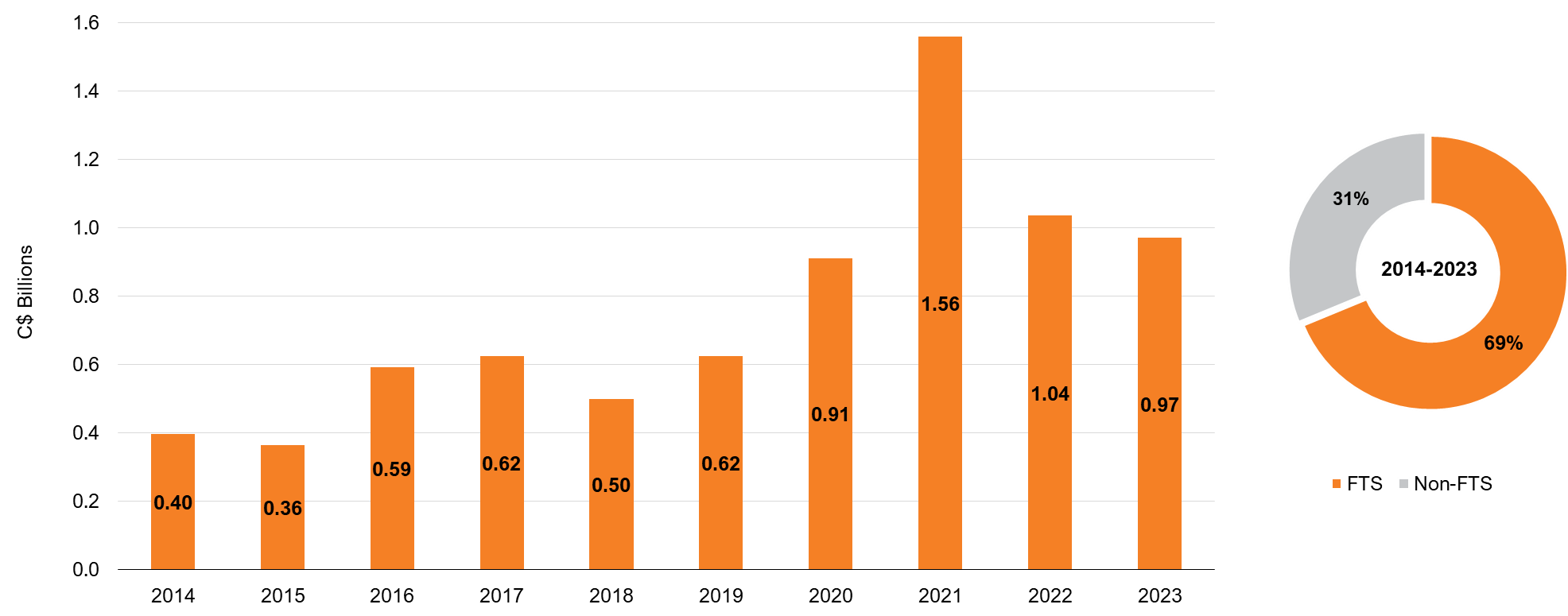

- Flow-through share financing contributes nearly 70% of the funds raised on Canadian stock exchanges for exploration across the country, generating significant exploration activity within Canadian borders.

Flow-through Share Financing (2014-2023)

The Mineral Exploration

Tax Credit (METC)

In addition to regular flow-through shares that provide 100% deduction for exploration, the federal METC is a 15% non-refundable tax credit applicable only to grassroots exploration in Canada, and deductible from federal income taxes payable.

Following extensive advocacy by PDAC, the METC has been extended until 2027.

The Critical Mineral Exploration

Tax Credit (CMETC)

Announced in budget 2022, the CMETC is an increase in the METC rate from 15% to 30% when the company is conducting grassroots exploration in Canada for certain critical minerals. The CMETC was announced for a five year period, until 2027.

Provincial Tax Incentives

On top of the federal incentives, a number of provinces provide additional tax credit to the provincial portion of income tax (calculated as % of the investment), which further reduce net cost to the investor.

- Ontario – refundable 5% tax credit

- British Columbia – non-refundable 20% tax credit

- Manitoba – non-refundable 30% tax credit

- Saskatchewan - non-refundable 30% tax credit

The provincial deduction and tax credits apply only to expenditures in applicable provinces and are only available to taxpayers residing within, or otherwise taxable in, the jurisdiction where the exploration is taking place.

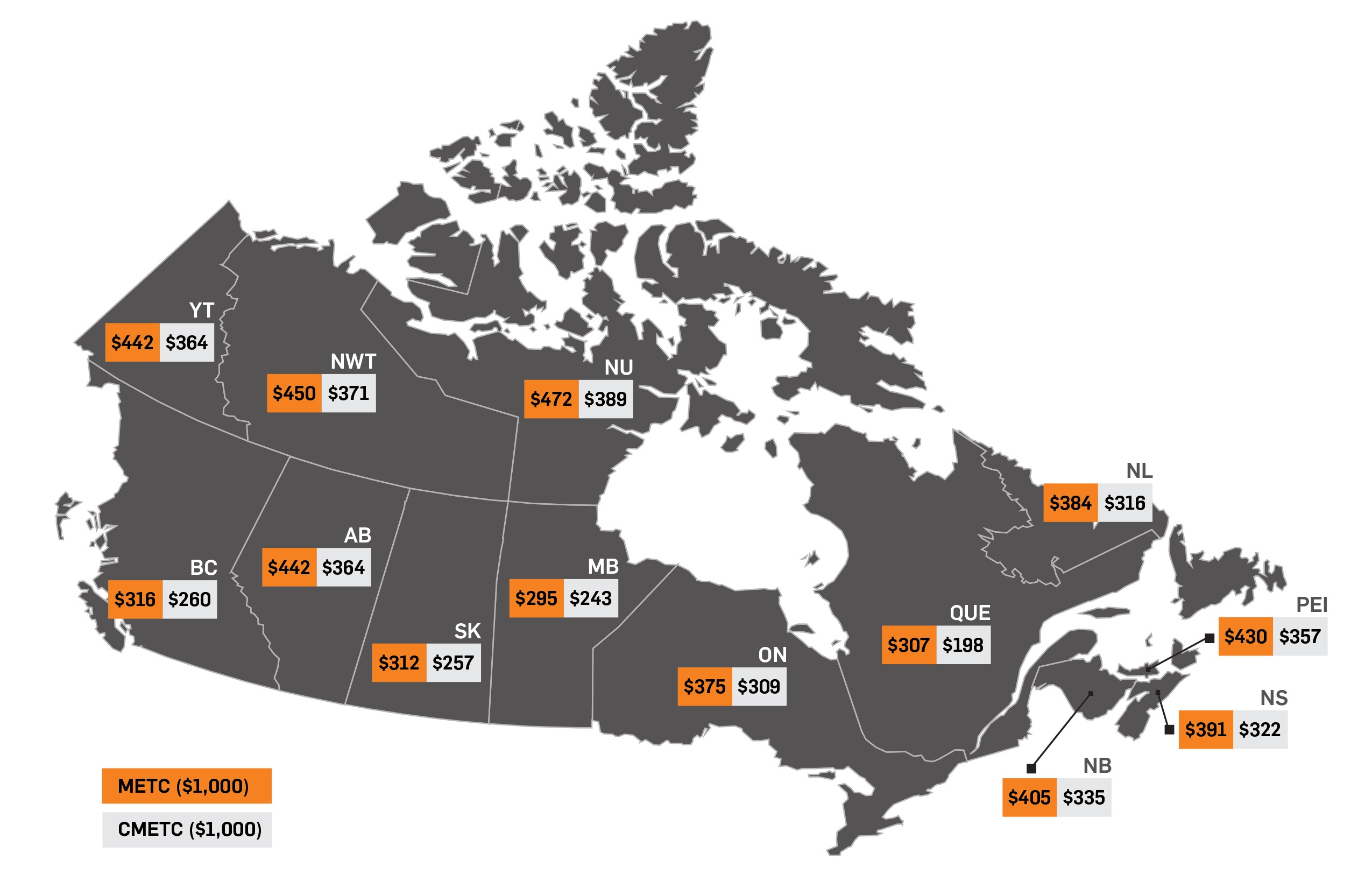

The effect of these incentives varies depending on the jurisdiction. See jurisdiction specific net cost on the map of Canada below.

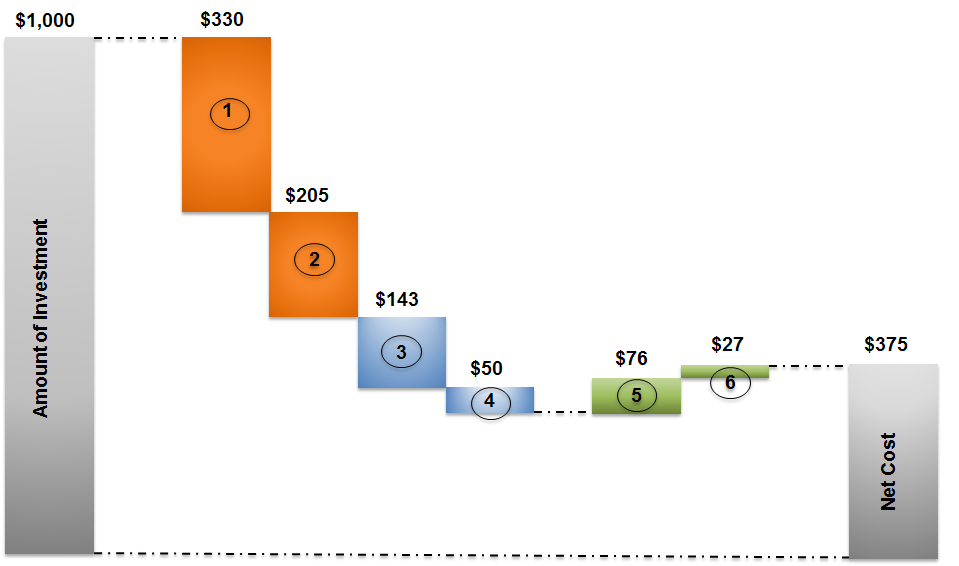

Flow-through Net Cost Calculation

Decrease of taxable income

1. Federal Tax Deduction = Investment * Federal Tax Rate

2. Provincial Tax Deduction = Investment * Provincial Tax Rate

3. Federal Tax Credit = Investment * (1-Provincial METC rate) * Federal METC Rate

4. Provincial Tax Credit = Investment * Provincial METC Rate

Increase of taxable income

5. Income Tax on Federal Tax Credit = Federal Tax Credit * Federal/ Provincial Combined Income Tax

6. Income Tax on Provincial Tax Credit = Provincial Tax Credit * Federal/ Provincial Combined Income Tax

Assumptions

- Maximum federal tax rate: 33%

- Maximum provincial tax rate: 20.53%

- Combined federal/provincial tax rate: 53.53%

Important To Know

Tax deduction vs tax credit: the federal tax deductions effectively reduce before-tax income, while tax credits apply directly to reduce taxes payable.

Tax credit:

- The federal tax credit can be carried back and applied against taxes paid in the previous three years. Unused tax credits may also be carried forward for a period of 20 years.

- The tax credits claimed are taxed as income in the following year.

Capital gains are based on nil purchase price.

Net Costs For Investors Across Canada

Based on $1,000 initial investment. Tax payer is assumed to be in the highest federal and provincial tax brackets.

For further information or to obtain hard copy brochures, please contact:

Prospectors & Developers Association of Canada

T: 416 362 1969 | E: [email protected] | www.pdac.ca