Economic Impacts Report

Economic Impacts of Exploration Projects

on Indigenous Communities

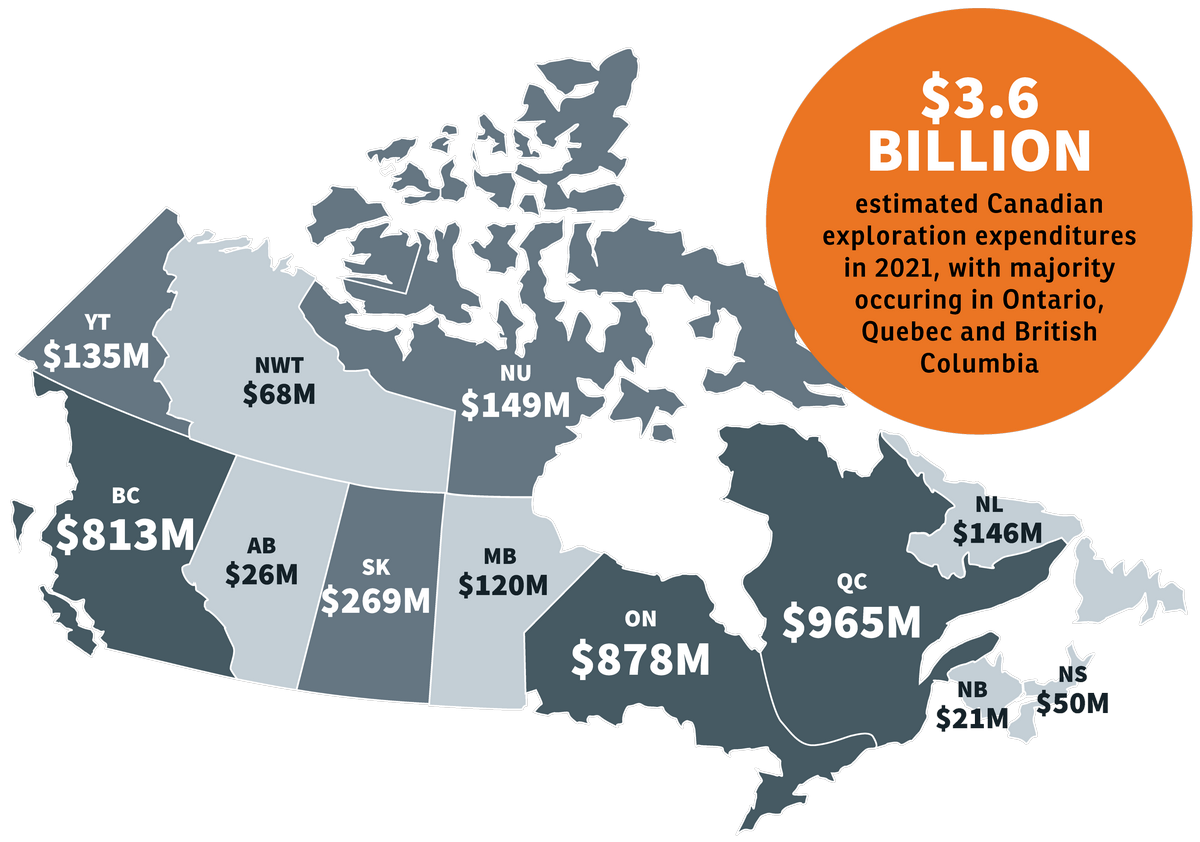

Exploration Spending

Mineral exploration contributes significantly to Canada’s Gross Domestic Product (GDP), at $2.1 billion in 2019 alone and the industry is proportionally the largest private sector employer of Indigenous Peoples in the country.

With many Canadian mineral exploration projects and mines located in northern and remote regions close to Indigenous communities, such regions are well-positioned to take advantage and benefit from direct and indirect business and employment opportunities that stem from exploration, mine construction, operation, and remediation phases of a mining project.

Many communities in remote, northern and Arctic Canada, whether Indigenous or non-Indigenous, have sought or are currently seeking to realize the considerable long-term economic benefits that a producing mine can bring to their local economies, including:

- Hundreds of new direct and indirect mining jobs.

- Business opportunities and capital-intensive activities required in mine construction and operation.

- New economic infrastructure, including improvements or installation of transportation, communication, power networks, and housing.

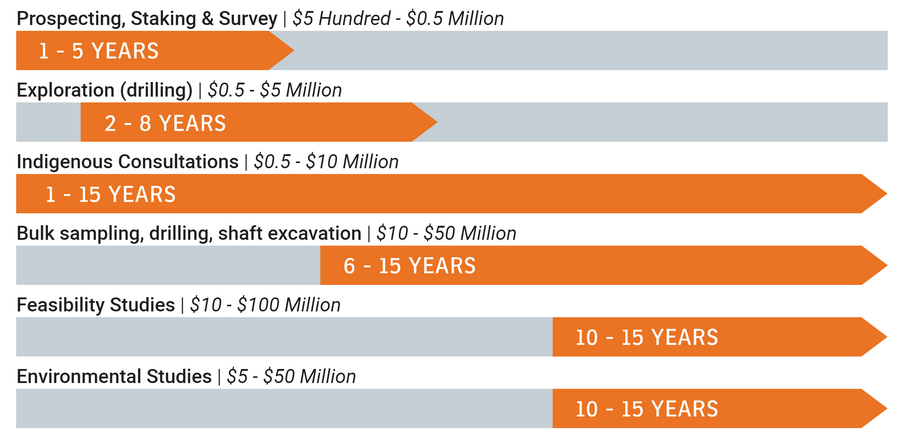

Estimated Exploration & Deposit Evaluation Budgets

In the intermediate exploration phase, a company may spend between $O.5 million and $5 million annually conducting drilling and supporting activities such as trail, road, and drill pad construction, small camp and core shack operation employing up to 10 people, transportation, and logistics. In 2015, Goldcorp's Borden Project spent $2 million within the local economy.

In advanced exploration, projects like Newmont Goldoorp's Coffee Project and Osisko Mining's Windfall Project can employ 100 or more on-site workers. Spending on bulk sampling, crushing, and excavation may top $20 million locally on an annual basis.

Economic Opportunities for Indigenous

Communities During Exploration

- Provide key services to support exploration, including staking, line cutting, drilling, fielding assistants, wildlife monitoring, and camp operation.

- Increase existing service offerings to include specialized scientific services, including geophysical and geochemical surveying, and environmental baseline information gathering.

- Develop and encourage local prospecting and early exploration to attract investment to their territories.

- Provide construction and logistical support for drill programs and advanced exploration projects, including air and marine transport and building and improving infrastructure.

- Invest directly in exploration and mining companies and projects.

Early Exploration

Key Activities

& Staking | and Water Sampling |

Economic impacts

Short-term, small-scale contracts for businesses with experience in field work, camp provision or surveying

Key risks to indigenous communities & businesses

- Communities may miss out on opportunities to participate in later phases of the project, depending on how involved they choose to be during early exploration in their territories

- Some projects may be incompatible with the community’s cultural, sustainability, or economic development goals

- The regional market is too small or saturated to justify the investment in technical skills and equipment needed to develop businesses

Intermediate Exploration

Key Activities

Economic impacts

Seasonal contracts on drilling, logistics, construction, heavy equipment operation, and camp operation worth between $0.5 million and $2 million or more annually. Seasonal employment opportunities for individuals on drill crews, providing camp services, operating a core shack or community office, and environmental wardens.

Key risks to indigenous communities & businesses

- Lack of appropriate governance structures, managerial and business planning experience within a community development corporation can prevent the corporation from investing appropriately in capital and human resources

- Political interference in a development corporation's operations can compromise efforts to establish strategic partnerships and obtain financing

- Indigenous businesses lacking the required human resources can be unprepared to respond to opportunities

- Limited capacity for effective community training programs

Advanced Exploration

Key Activities

Economic impacts

Long and short-term contracts valued in the tens of millions over a period of several years focused on drilling, excavation, construction, logistics, and operation of a semi-permanent camp. Significant direct employment opportunities for driller helpers, heavy equipment operators, camp services, security, and professional managerial positions (e.g., human resources, surveying, geologists, environmental sciences and monitoring)

Key risks to indigenous communities & businesses

- Investments in assets and training can be jeopardized when projects are delayed or canceled

- Poorly structured partnership agreements can cause financial/ legal challenges or fail to meet capacity building objectives

- Existing human resources may not be appropriate for specialized equipment required in advanced exploration

- Limited capital and access to financing can prevent businesses from scaling up to fulfill contracts

Indigenous Communities Steps

There are several steps Indigenous communities can take, to make the most out of the economic opportunities associated with mineral exploration, starting with the development of good governance and management models for their community-owned businesses.

Exploration companies can help by engaging early and often with communities to build awareness of their projects and keep the lines of communication open allowing Indigenous businesses to bid on contracts and build appropriate training programs.

Further examples include:

Invest in Early Exploration Activities

Drilling

Opportunities in Construction & Logistics

Project Equity & Revenue Sharing Agreements

Invest Directly in Exploration Companies & Projects

Grow Enterprises and Build Entrepreneurs around Environmental Monitoring

Land-based Opportunities in Early Exploration

Grow Existing Services to Include Specialization in Geochemical & Geophysical Surveying

Impacts on Indigenous Businesses

In knowing the opportunities and impacts, it is important that communities understand that the viability of the services being offered is highly dependent on three principal variables:

- The level of early exploration activity

Sustained interest by multiple prospectors and companies within a community’s traditional territory or jurisdiction can potentially support a business or businesses servicing the early exploration sector. - A community’s ability to track and understand the level of early exploration initiatives in their territory

Without this knowledge, Indigenous businesses will be unable to market their services and plan for the expansion and development of early exploration projects. - The market must be strong

The market for specialized services can be saturated by experienced providers. While an Indigenous community-owned business will typically enjoy some advantages in its traditional territory, new companies seeking to offer geophysical and geochemical surveying within mature mining districts with advanced exploration service sectors, may encounter difficulty penetrating the market. Furthermore, Indigenous businesses offering specialized services will need to demonstrate an adequate level of expertise and experience.

As noted in the three key considerations above, the exploration phase of the mineral development sequence is highly dependent on availability of financing and fluctuating global commodity prices, not to mention uncertainty surrounding the value of the deposit being explored. Therefore, the establishment of businesses solely catering to this sector, is fraught with risk. Indigenous businesses that invest in new equipment and training in order to participate in projects can lose that investment when a project, or group of projects, disappears or is substantially delayed.

Projects may be delayed or cancelled because a company exhausts its exploration budget, or the price of the underlying commodity does not justify continued investment. The fact that junior exploration firms tend to raise exploration dollars annually also makes it difficult for them to commit to long-term contracts. Consequently, impacted communities are often provided with short-term opportunities, which can make financing of equipment purchases difficult.

Community Risk, Mitigation and Strategies

There are several steps Indigenous communities can take to make the most of the economic opportunities associated with mineral exploration, starting with the development of good governance and management models for their community-owned businesses. Exploration companies can help by engaging early and often with communities to build awareness for their projects and keeping the lines of communication open so Indigenous businesses can prepare to bid on contracts and build appropriate training programs.

Early Engagement

WHAT COMMUNITIES SHOULD DO:

Insist on Early Engagement with Proponents

Communities should develop strategies or engagement protocols to engage proponents at the earliest possible moment in the project cycle. This is an important first step toward building an understanding of future economic opportunities.

WHAT COMPANIES SHOULD DO:

Engage Early and Often with Communities and Indigenous Businesses

Companies must keep communities well informed about project planning on an ongoing basis so they have time to plan to take advantage of opportunities around the project and build a realistic understanding about potential economic benefits.

Partnerships

WHAT COMMUNITIES SHOULD DO:

Strategic Alliances

Joint ventures with experienced companies or another community can help development corporations access the market for exploration service and supply, build internal capacity, and train employees.

Exploration Agreements

Exploration agreements can help communities build strategic alliances, prepare competitive bids, build training programs for community members, and establish future revenue sharing agreements should the project proceed to commercial production.

WHAT COMPANIES SHOULD DO:

Monitor Joint Venture Opportunities for Indigenous Businesses

Companies should proactively identify opportunities where Indigenous communities and businesses can partner to build internal capacity and create value.

Community Capacity

WHAT COMMUNITIES SHOULD DO:

Establish Good Governance Structures & Build Managerial Capacity

Community development corporations should take steps to ensure they are governed appropriately and remain free from interference by political leaders. Establishing an arm’s length board of directors to oversee budgeting and other key processes is an important first step. If necessary, experienced, qualified managers should be hired to oversee finances, investment in capital and human resources, and partnership agreements.

Land Use Plans & Mining Readiness Strategies

A land use plan can increase a community’s capacity to select the projects it wishes to become involved in and avoid conflicts with proponents and the Crown. A community mining readiness strategy based on input from community members, other communities, regional proponents, and other stakeholders can increase region-based preparedness for economic opportunities.

Inventory Community Assets & Skills

An updated inventory of community capital assets, local Indigenous businesses, and community skills can help inform discussions around participation in projects and capacity building with companies and joint venture partners.

Build Training Programs

Communities, joint venture partners, and companies should work with Indigenous Skills and Employment Training (ISET) agreement-holders and educational institutions to design appropriate training programs.

WHAT COMPANIES SHOULD DO:

Understand Community Capacity

Meeting with community members and economic development leaders to learn about community assets, including machinery, facilities, infrastructure, human resources, and portfolio of community- owned businesses is a good way to determine how Indigenous businesses can best contribute to an exploration project or strategic alliance.

Depending on the commodity, its future market outlook may be far from clear.

This is more likely to be the case for rare earth elements and minerals that do not have well-known industrial applications or investment history.Finally, the prospects for exploration success are typically slim and projects can fail to reach the development or production stages due to an array of factors, which can negatively impact service providers and related businesses.

Communities should be mindful of potential liability they take on as a result of business initiatives they pursue. The figure below illustrates how communities can mitigate risk and implement strategies to reduce such risk. In light of the challenges facing Indigenous businesses, the following five recommendations from the report are steps that governments and industry can take to improve the likelihood that Indigenous businesses can succeed in opportunities associated with mineral development.

1. Build governance capacity within Indigenous businesses

Federal and provincial governments currently provide funds to Indigenous communities to build consultation capacity, train workers, and assist in the establishment and growth of Indigenous businesses. Both levels of government should invest in funds that can deliver capacity-building programs to Indigenous communities in order to build and maintain appropriate governance structures around community-owned businesses, development corporations and strategic partnerships.

2. Support land use planning and traditional use studies

Governments that have not already done so, should provide Indigenous communities with funding to develop land use plans and undertake land use studies, including mapping of valued community resources to support community planning around resource development. This funding can help prepare communities to decide where or when they are best able to support and participate in projects. Funding should also support multi-community planning efforts around regional development in areas with proven mineral resources and potential for the development of shared infrastructure.

3. Study industry standards to review strategic partnership agreements

Industry groups, including PDAC, the Mining Association of Canada, as well as provincial and territorial prospectors and mining associations should work with Indigenous organizations to study existing standards in jurisdictions such as Nunavut for reviewing Indigenous joint venture agreements (and other strategic partnerships) to ensure they contribute to Indigenous community capacity-building objectives. Study findings can be used to assist companies and communities that lack existing policies or are developing new policies.

4. Build capacity around improved consultation and engagement within the exploration phase of the mineral development sequence

Governments, industry, and communities should respond to the Canadian Minerals and Metals Plan’s recommendation to develop capacity-building programs that support Indigenous participation in the mineral development industry. Support may include development of toolkits that combine existing regulations and existing best practices and standards to improve early engagement efforts and Indigenous community and business efforts to participate in exploration through building awareness of projects, strategic partnerships, and coordination with Tribal Councils and other community affiliations.

5. Support Indigenous prospecting initiatives in remote regions

Emulating Québec’s support for the Cree Mineral Exploration Board and Nunavik Exploration Fund, federal, provincial and territorial governments should provide funding to Indigenous authorities and organizations, including First Nation Governments, Tribal Councils, Métis Councils, and Inuit Associations to raise awareness of early exploration opportunities and encourage local prospecting in remote regions in order to attract investment.

Additional Resources

The following guides and handbooks can help companies and communities plan for participation in mineral exploration and mining projects:

- Aboriginal Human Resources Council - Navigation Guide: Major Developments – Aboriginal Partnerships

- Association for Mineral Exploration BC - Aboriginal Engagement Guidebook: A Practical and Principled Approach for Mineral Explorers (2015)

- British Columbia Assembly of First Nations - Economic Development Toolkit: Indigenous Leaders’ Business Partnership Roadmap (2019)

- Canadian Career Development Foundation Case Study - Mining Essentials: A Work Readiness Training Program for Aboriginal Peoples (2014)

- Canadian Centre for Community Renewal, Tr'ondëk Hwëch'in, and Canadian Northern Economic Development Agency - Aboriginal Mining Guide: How to Negotiate Lasting Benefits for your Community (2009)

- Community Futures BC - Aboriginal Engagement Toolkit (2008)

- Gordon Foundation - IBA Community Toolkit: Negotiation and Implementation of Impact and Benefit Agreements (2015)

- National Indigenous Economic Development Board - National Indigenous Economic Strategy for Canada (2022)

- Natural Resources Canada - Exploration and Mining Guide for Aboriginal Communities (2013)

- Natural Resources Canada - Mineral Exploration Estimates

- Terrace Economic Development - First Nations Joint Venture Partnership Toolkit (2012)

- Woodward and Co. - Benefit Sharing Agreements in British Columbia: A Guide for First Nations, Businesses and Governments.